Allowable Expenses means the Usual and Customary charge for any Medically Necessary Reasonable eligible item of expense at least a portion of which is covered under a plan. 2 CFR Part 200 Section Reference Description 434 Contributions and donations made are unallowable.

The Lesser Known Art Of Calculating Irs Allowable Living Expenses

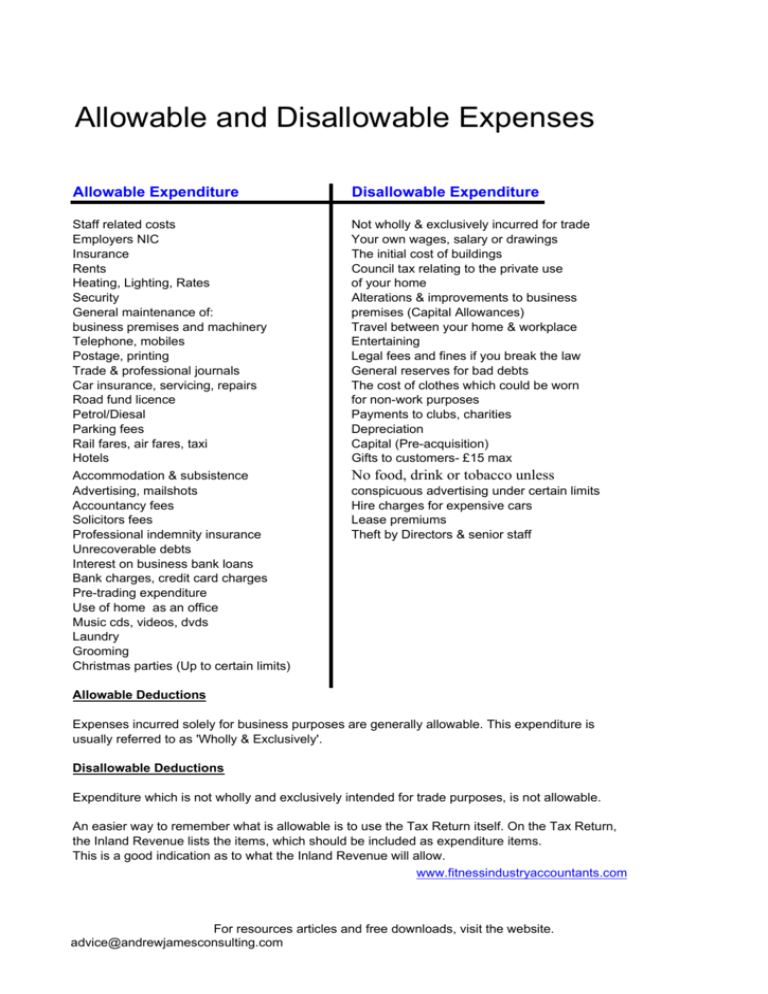

The list of deductible business expenses includes obvious ones like office rent salaries and computers but might also include water bills and window cleaning.

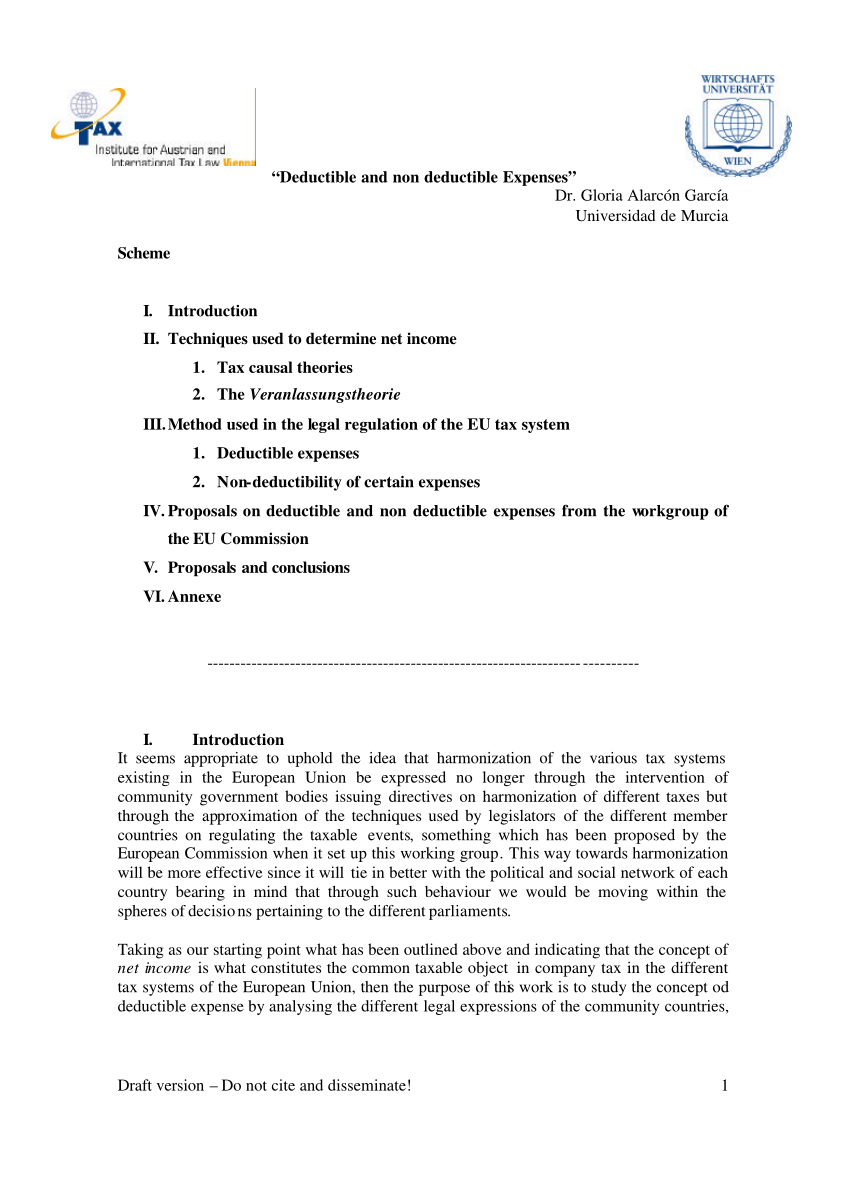

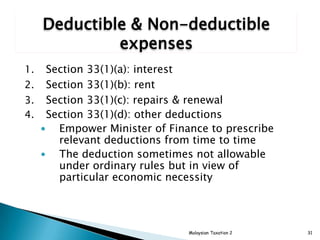

. 435 Defense and prosecution of criminal and civil proceedings claims appeals and patent infringement are generally unallowable. 14102 Unallowable Costs. Allowable deductions Allowable deductions from the business income of a private trust or private company are as follows.

However meals may be allowable as provided under. Here are most common ALLOWABLE EXPENSES. Employment costs to employees such as salary allowance EPF SOCSO Business insurance Rental of premises.

Costs for home testing and personal protective equipment PPE for COVID-19. Related meetings and events to transport victims to access. The following list contains examples of items that can be purchased with the PCard.

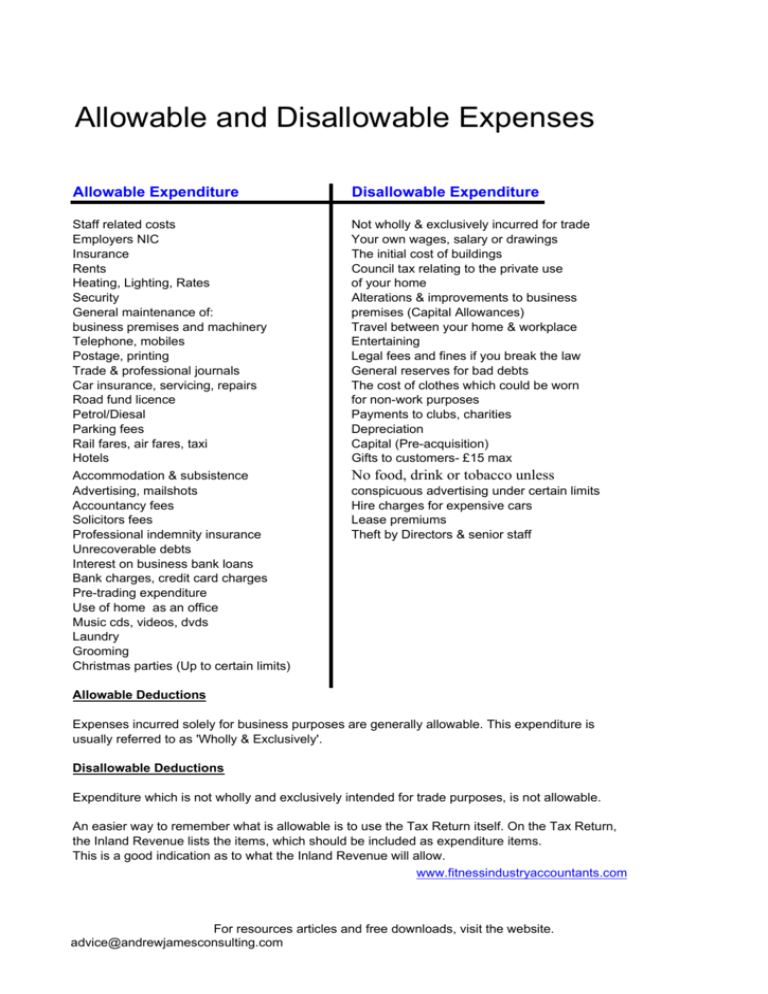

Summary This topic contains information on. Staff entertaining is an allowable expense for company tax purposes whereas client entertaining may be an allowable expense and a portion may be disallowed for company tax purposes. OMB Circular A-122 is the Cost Principles for Non-Profit Organizations.

The most common fines and penalties are late fees on federal and state tax returns. The intent of this list is to indicate some of the allowable and non-allowable expenses per the State of Washington Moving Expense Regulations and Guide. FAR 31 provides numerous examples of allowable and unallowable costs so lets break down these cost types and the rules the US.

Government has put in place to interpret the differences. The department charges one-third of the cost to non-SU allowable foreign travel 52447 and the remaining two-thirds to non-SU unallowable. Track Your Expenses Easily With QuickBooks - Highly-Rated Tracking Software.

It was codified in the Code of Regulations CFR and is now called 2 CFR 230. Entertainment and Personal Expenses. APPENDIX A EXAMPLES OF ALLOWABLE AND UNALLOWABLE EXPENSES Allowable Expenses Office and instructional supplies Advertising 1000 or less Maintenance Service Agreements 1000 or less Professional Services - non-individual 1000 or less Computer peripherals printers scanners fax disk drive etc Promotional items Pens mugs etc Software.

The code specifically identifies categories of allowable and unallowable costs which well see in subsequent. Cost Category Allowable Cost Examples Unallowable Cost Examples Mileage reimbursement for program employees to use their Mileage reimbursement non-grant funded personnel or personally owned vehicles to travel to participate in project- grant-related activities. When some Other Plan pays first in accordance with Section 1006A herein this Plans Allowable Expenses shall consist of the Plan Participants.

Legal feesoften for share capital or capital items such as equipment or. All PCard purchases are subject to review. Allowable deductions and non-allowable deductions.

Customer gifts under 50 and not including products with advertising. Maintenance Costs credits to Buyer for repairs Loan Costs and any Fees associated with a Lender. The expense is allowable if the figure quoted is reasonable.

Understanding which line item you may allocate and bill as allowable is important to avoid potential government penalties down the road. Type of Expense Allowable Unallowable Mailings information on testing dates Title I activities and services etc X Office equipment printers copiers fax machines etc X Non-promotional pamphlets or brochures for informing parents of assessments school achievement important dates etc X Parent award events banquets etc. Subject to Article 87 of the Regulation eligible expenditures of this Programme are.

Date of effect This topic has effect to controlled private trusts and controlled private companies from 1 January 2002. 41 rows When coding an expense for an activity that is allowable to be paid with University funds but unallowable for indirect cost recovery you must identify that expense as unallowable for reimbursement. These conditions are.

Employment costs to employees such as salary allowance EPF SOCSO Business insurance Rental of premises. Legal fees are usually allowable and this includes costs of chasing debts defending trademarks preparing legal agreements. And here is a list of the common non-allowable expenses that businesses try to claim.

Some business insurance premiums may be tax deductible depending on local regulations and your insurance policy. OMB stands for Office of Management and Budget. If youre self-employed your business will have various running costs.

This office publishes circulars. Ad Easily Track Your Business Expenses - Get Started With QuickBooks Today. Related to Non-Allowable Expenses.

The following is a list of expenses that are typically found on a closing statement and are generally considered Non-Allowable Exchange Expenses. Here are most common ALLOWABLE EXPENSES. Tax deductions work by reducing your taxable income by certain amount.

438 Entertainment costs including amusement diversion and social activities and any costs directly associated with such costs are. They are not tax credits which reduce your total tax dollar-for-dollar. You can deduct some of these costs to work out your taxable profit as long as theyre allowable expenses.

Non-approved donations Employees leave passages Interest royalty contract payment technical fee rental of movable property payment to a non-resident public. These along with parking tickets safety violation fees and any other fines are non-tax-deductible expenses. Legal and professional fees.

Donations unless they contribute via Gift Aid. Non-Reimbursable Expenses In addition to the non-reimbursable items set forth above in this Policy the following is a non-exhaustive list of expenses that will not be reimbursed by Williamson County. Recipients may use PRF payments for allowable expenses or lost revenue incurred prior to receipt of those payments ie pre-award costs so long as they are to prevent prepare for and respond to coronavirus.

The cost of home testing for COVID-19 and PPE is an eligible medical expense that can be paid or reimbursed under health flexible spending arrangements health FSAs health savings accounts HSAs health reimbursement arrangements HRAs or Archer medical savings accounts Archer MSAs. An expense is warranted as an allowable expense only if it is wholly and exclusively incurred for revenue production. Non-approved donations Employees leave passages Interest royalty contract payment technical fee rental of movable property payment to a non-resident public.

Title insurance fees for lenders title insurance policy. Allowable purchases must be for official University related business with a clear business andor research purpose. It costs money to make money and much of what business owners spend on their companies their business expenses can be deducted from their gross income to reduce their taxes.

When applicable purchases must be made via myUF Marketplace. Costs of amusement diversion social activities ceremonials and related incidental costs such as bar charges tips personal telephone calls and laundry charges of participants or guests are unallowable. Be sure you and your department mutually understand your authorized limits.

HHS expects that it would be highly unusual for providers to have incurred eligible expenses prior to January 1 2020. When you have 50000 of taxable income but deduct 15000 in itemized deductions you then are only taxed on 35000 instead of your full income of 50000 50000 - 15000 35000. List of Non-Allowable Business Expenses.

One must provide substantiating documents that the expense at hand indeed was incurred solely for income generation. Appraisal and environmental investigation.

Alabama 21st Century Community Learning Centers Ppt Download

What To Include In Your Business Expense Policy Sentrichr

Allowable Disallowable Expenses

The Ultimate List Of Tax Deductions For Online Sellers In 2020 Gusto

List Of Tax Deduction For Businesses Cheng Co Group

General Expenditures Examples Of Allowable And Unallowable Costs Child Nutrition Nysed

Pdf Deductible And Non Deductible Expenses

List Of Tax Deduction For Businesses Cheng Co Group

Allowable And Non Allowable Business Expenses

Chapter 5 Corporate Tax Stds 2

Common Hsa Eligible Ineligible Expenses Optum Bank

What Are Non Deductible Expenses Rydoo

The Ultimate List Of Tax Deductions For Shop Owners In 2020 Gusto

List Of Tax Deduction For Businesses Cheng Co Group

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Claiming Business Expenses A Guide For The Self Employed Citywire

Allowable Disallowable Expenses

What To Include In Your Business Expense Policy Sentrichr